Ahhh… Just look at that data. Isn’t it beautiful?

Okay, well that data may not be attractive to the eye, but what if I told you that with this information assisted me in making $1,000+ ? Now It’s beautiful, right?

Many people say, “Trent, how do you make all that money with that picture?” And I simply say, “cryptocurrency trading“.

Being a trader means you’re adept at taking advantage of opportunities in the market. You learn and follow current trends to understand how they affect the market.

Sometimes, opportunities come in different forms, such as cryptocurrency trading. For the average trader, this can be uncharted waters, and it requires a slow approach as you learn the specifics.

Most traders usually opt to start with Bitcoin. However there are other alternative cryptocurrencies, such as : Ethereum, Ripple, Litecoin, Monero, Golem, Zcash, and Dash, that can yield income for you.

So, if you’re interested in this kind of trading or you’re just want to try out cryptocurrency trading, then this guide is for you. We’re going to show you exactly how to trade in cryptocurrencies and give you a few reasons you need to engage in this trading.

Are you ready? Let’s get right into it!

What is Cryptocurrency?

Cryptocurrency is typically a digital currency that operates independently of a central bank. The generation of this currency is done using an encryption technique known as cryptography.

This encryption makes it difficult to counterfeit the currency. Plus, the fact that a central body does not issue it makes it immune to manipulation or interference. As a result, a lot of people are looking into cryptocurrency as a secure and anonymous way of transacting their money.

Bitcoin was the first digital currency to hit the market, and it was introduced by an anonymous programmer or group using the pseudonym Satoshi Nakamoto in 2009. The success of Bitcoin precipitated the rise of other currencies such as Namecoin, PPCoin, and Litecoin.

Prices of digital currencies are usually affected by supply and demand , so rates tend to fluctuate widely. This is both a good and bad move. Good as it allows you to get many folds in return of your investment, bad as your portfolio’s worth may go down within a few weeks. Generally, as the currency becomes more popular, like Bitcoin and Ethereum, they become more stable and resistant to fluctuations in their value.

Like most digital systems, cryptocurrency is not immune to hacking threats. Bitcoin has already been a victim to over 40 thefts in its short history.

Why You Should Consider Cryptocurrency Trading

First, cryptocurrency trading is a good opportunity to add an income source to your portfolio. Don’t be surprised to find coins that experience a fourfold increase in value in less than a week. This can be great if you make the right predictions.

In the cryptocurrency trading world, information is transparent as all finalized transactions are available for all traders to see. You can verify transactions anytime using the Bitcoin blockchain. Cryptocurrency algorithms cannot be manipulated, due to their cryptographic nature.

For most traders, inflation is one of the biggest threats when it comes to trading. This is not the case with crypto coins. For example, Bitcoin has a cap of 21,000,000 to limit the supply. The system will stop creating new coins, once the cap is reached.

There is minimal collapse risk with cryptocurrency as no central body has authority over it. Fiat currencies are likely to be affected by government policies. Crypto coins are virtual currencies, which are not controlled by any government.

The value of cryptocurrencies is likely to rise if they get adopted for a number of different uses, such as a payment of option in major retailers. Newegg already offers Bitcoin as an alternative payment option.

Also, more investors are taking cryptocurrency trading serious and are already adding it to their portfolio. You should, too!

History Of Cryptocurrency

Cryptocurrency is not a new phenomenon. In fact , the idea has been around for several decades, however, there needed to be a lot of research conducted for a successful implementation and several mathematical formulations to be worked on for securing the currency from all economic and security liabilities.

Bitcoin was the first cryptocurrency that truly boomed due to the secure and anonymous infrastructure used by its founding group. Many cryptocurrencies followed bitcoin’s steps, but some did not see the sun for a long time.

The journey of cryptocurrency has just begun and many new currencies are yet to launch, while many presently active ones might go down with time.

Getting Into Cryptocurrency Trading

Assumedly, you have heard a thing or two about cryptocurrency trading. That’s why you considered this move in the first place, right?

The first thing you want to keep in mind is that cryptocurrencies are commodities and not stocks. They have prices, which tend to vary widely. There are many things you will need to learn, if you want to master the art of cryptocurrency trading.

As you get started, having some basic understanding of consumer demand, economics, and business will give you an edge over other traders.

Then, you want to get a wallet, which you’ll use to buy cryptocurrencies, such as Bitcoin and Ethereum, and protect them. Cryptocurrency is not tangible and cannot be stored in your usual wallet. However, there are wallets available in online or offline forms that store the digital keys which give you access to your cryptocurrency.

There are two kinds of keys stored: private and public. The private key is a string of random variables and should be kept safely with you. It redirects you to the public key. The public key is a code which connects to the amount of money you have. Once you have your wallet, you can start making transactions in cryptocurrecy and also keep track of all transactions personally. Your wallet is the only way to access your cryptocurrency and losing it means losing all your money (this is why it is not recommended to keep all your holdings in a single wallet).

As aforementioned, there are online and offline wallets available for securing your private keys:

- Desktop wallets

- Mobile wallets

- Hardware wallets

- Paper wallets

While the type of wallet available for your cryptocurrency depends on its popularity and frequency of use, major currencies like Bitcoin and Ethereum support all these types of wallets.

Note: Some wallets can have malware attempting to exploit your private keys. Never trust a wallet software that originates from a source that you don’t know and trust.

Quick Tip: Never expose your private key address. Only do so when you’re ready to spend your funds.

Now that we have all the information to start, let us now look at where to start trading cryptocurrencies.

Where to Trade

Finding a safe and secure exchange place is important. Fiat currencies have different renowned places for trading, but the case with cryptocurrencies are somewhat different. However, some renowned institutions allow traders to use Bitcoin, the most popular cryptocurrency.

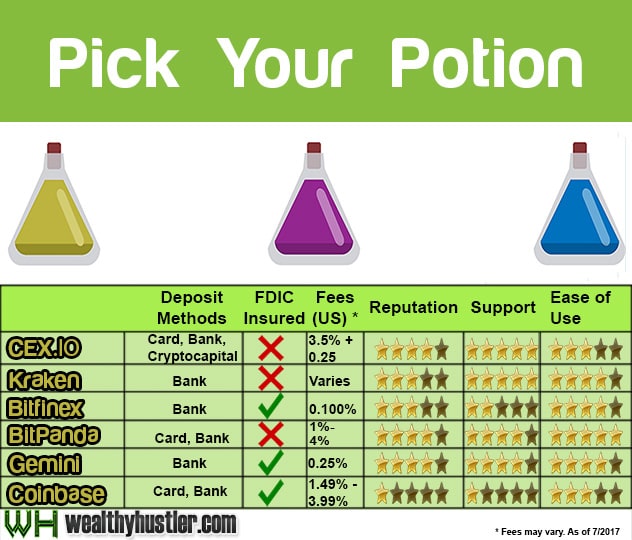

Some reputable places you can register for an account and start trading include CEX.io, Kraken, Bitfinex, BitPanda, Gemini and Coinbase. These are all beginner friendly websites and will not overwhelm you with confounding terminologies.

While there are other notable cryptocurrency exchanges online, most of them do not allow you to purchase cryptocurrencies in US dollars (hence impractical for first timers), but the ones mentioned here allow you to deposit USD from your bank card or through a deposit.

In the below chart you can see all the features present in these exchanges and pick out the platform which is most optimum for you. Be sure to read user reviews to get a relative understanding of how they work.

Also, each exchange place has its own rules and policies, which you’ll need to read and understand before you start trading.

Keep in mind that cryptocurrency trading is still in its infancy. So, exchanges may come and go. For those who have been around for some time, the Mt. Gox scandal might be familiar to you.

Basically, take the time to research on different exchange platforms and determine the right option for you. Determine their regulations, location, fees, and liquidity.

Quick Tip: Be aware of Coinbase. Although this company is legitimate, in terms of being a working cryptocurrency trading platform, they tend to go offline when the value of a popular coin such as Bitcoin or Ethereum go down. This is because they do not want people to sell their coins to them instantly, because the value is down and they would lose money.

Define Your Strategy

Well, now you have a wallet with cryptocurrencies, and you have picked the right exchange place for you. So, what’s next?

You want to first determine your buying and selling frequency. In most cases, holding can be the best bet in cryptocurrency trading. However, there are times when you’ll need to cut and run, especially when there are declines due to unforeseen structural issues.

Find your desired market in which you want to trade. Before making your move, you want to analyze and understand the market well (fundamental analysis). Don’t just start trading blindly. Try learning as much as you can about the coins you are interested in.

Having the right information and knowing how it will affect the market allows you to make clear predictions. Technical analysis of the charts will help you determine the prices at which coins will fall.

Try Automated Bot Trading

Sometimes it can be tiresome and demanding to keep staring at the charts all day. If you want to keep your passive income consistent, you may want to consider using an automated cryptocurrency trading bot to follow and track the indicators at any time on all coins.

Bots don’t sleep and never get exhausted, so you can keep it active at any time you wish. Cryptocurrency bots are usually managed on an external server, which means you don’t need to have your computer running all day for them to work.

With the trading bot, you’re in control, and you can set your own parameters and rules by which it works. For example, you can create a trading rule that states: “If this indicator crosses that indicator, buy. If not, wait for the indicator.”

Most bots already have modules for strategies and instructions, so you don’t need to be a coding pro to set them up. Some great examples of automated trading bots include Haasbot, Tradewave, Zenbot, CryptoTrader, BTC Robot, and Gekko.

Also, tracking cryptocurrency prices are even easier today with just a simple app on your phone. Apps, such as Coincap and Blockfolio, allows you to get current prices of each coin in the market.

Ten Rules For Successful Trading

While different people have a different approach to cryptocurrency investing and trading, the following ten rules are a set of safe and proven strategy for first-time traders:

- Base your portfolio on bitcoin as it is the most reliable and stable currency

- Be bold but take calculated risks

- Track the growth charts of major currencies and learn to read similarities

- Scale out

- Keep track when a dip occurs but do not sell during dips

- Buy more during dips

- Avoid following the herd and learn to have confidence in your calculations

- Lock a set amount of currency securely and trade with the remaining amount

- Make moves after 5 or 7 days

- Study upcoming coins and pick out which one to invest in Leverage but to a limit

Success Stories: From Ordinary To Millionaires

Many people have changed their fortunes by investing in cryptocurrencies. Check out some of the success stories to motivate yourself in to getting involved and investing:

- Mr Smith (a nom de plume) made 25 million dollars from an underlying venture of 3,000 dollars — those are the kind of profits that make a Bitcoin tycoon. Smith still claims 1,000 Bitcoins, which he intends to offer when BTC reaches an exchange rate of 1 BTC:150,000 USD, a millionfold return for his initial cost. He is optimistic about BTC rates surging to such heights once governments and big firms confiding in the currency. Read more about his fascinating investment success here.

- Ex United States Marine Jered Kenna made millions of dollars after investing in BTC when it was still valued at $0.20. He invested his profits in launching various ventures such as Tradehill, a bitcoin mining pool, and 20mission, a workspace for freelancers and startups.

- Erik Finman is a teenager who possesses 403 bitcoins, which at the current $2,700 a coin puts his bitcoin holdings at $1.09 million. He likewise has interests in different digital currencies, including litecoin and ethereum. Finman started putting resources into bitcoin in May 2011 at 12 years old, with a $1,000 gift from his grandma becoming his starting point.

These are just normal people who invested when they saw an opportunity and made the right choices to become financially successful. This should show you that cryptocurrency trading can be done by anybody who is determined.

A recent article in Forbes shows that the age of cryptocurrencies has just begun and there are many more millionaires to be made. While I will not guarantee that you will become a millionaire, the statistics reveal that if you are ambitious enough you are bound to make a profit in the long run.

The Future of Cryptocurrency

Looking into the future, people in the crypto community are confident that virtual currencies are here to stay and will make an important part of the economy. Some experts believe that coins, such as Bitcoins, will not only be used as a payment method, but also as a store of value.

Ethereum has one of the major products in the crypto community known as smart contracts. These are computer protocols that are believed will replace lawyers. With these protocols, parties can execute contractual terms without the need of an intermediary.

Zcash is also another great coin that now offers complete anonymity for all transactions. Essentially, it’s impossible to identify the people or the amount of money involved in a transaction using the data stored on the blockchain. This feature could be vital in Zcash’s future.

There are different digital currencies and it seems like a birth of a new coin occurs every day. According to many experts, not all of them will live to see the future. So, traders need to be careful when choosing the right coins to use.

Cryptocurrency Trading – The Bottom Line

If you want to adopt another strategy to make money online, then you ought to give cryptocurrency trading a try. With cryptocurrency trading, you need to establish and follow your rules to take advantage of what other people don’t.

Investors and traders are getting into cryptocurrency trading for a variety of reasons. Some have opted for Ethereum because the Enterprise Ethereum Alliance has been successful in acquiring new partnerships.

A good number of people have invested in Bitcoin because it’s seen as a safe haven when it comes to trading in cryptocurrencies. If the demand of these currencies continue and investors start to perceive digital coins as alternatives to other financial options, we’re looking at explosive growth and increased market cap in the future.